Bold, a financial technology firm dedicated to building an electronic payments infrastructure in Colombia, has secured $50 million in Series C funding, with General Atlantic leading the investment round. This latest round saw participation from existing investor International Finance Corporation, a member of the World Bank Group, along with previous backers InQLab and Amador. In total, Bold has raised $130 million in funding, according to company co-founder and CEO José Vélez.

Empowering Small and Medium Businesses

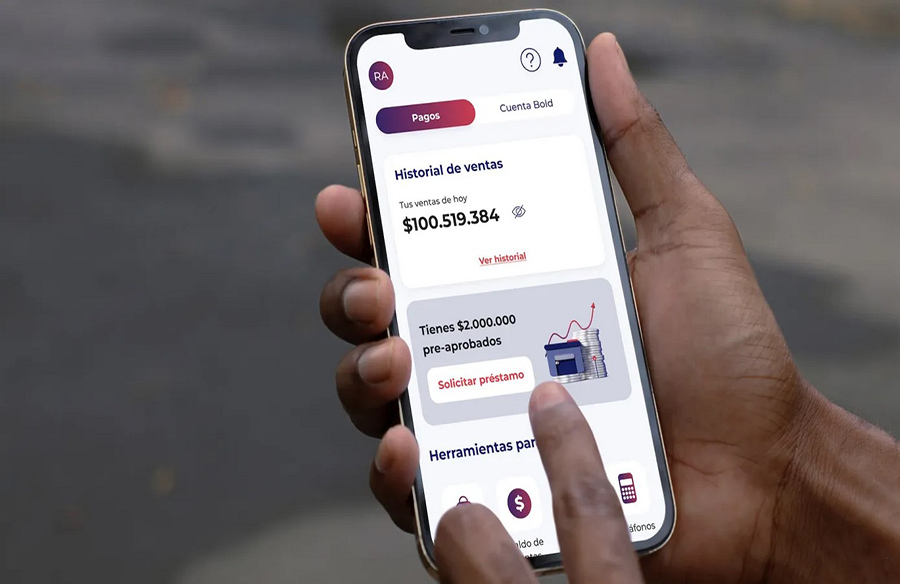

Bold specializes in providing low-cost payment terminals, known as dataphones, which facilitate digital transactions for small and medium enterprises (SMEs) in Colombia. These terminals enable businesses to accept link payments and various local payment methods, fostering financial inclusivity and expanding the reach of digital payments.

Accelerated Digital Adoption Amidst COVID-19

The COVID-19 pandemic accelerated the shift towards digital payments in Colombia, positioning Bold as a beneficiary of this transition. With the demand for digital financial services on the rise, Bold’s innovative solutions have gained significant traction, empowering merchants to adapt to changing consumer preferences and market dynamics.

Rapid Growth and Market Penetration

Since its previous funding round in 2022, Bold has experienced substantial growth, with its customer base expanding from 100,000 to 150,000 monthly active merchants. Additionally, the company has more than doubled its workforce, now boasting over 800 employees compared to 380 in 2022. Bold’s revenue has surged sixfold since 2022, consolidating its position as a key player in Colombia’s digital payments landscape, commanding approximately 3% of the market share by current transaction volume.

Seizing Market Opportunities

While cash remains predominant in Latin America, electronic payments are gaining momentum, particularly among younger demographics embracing credit cards and online shopping. Bold aims to capitalize on this trend by enhancing its product offerings and leveraging strategic partnerships with other fintech startups to expand its market presence.

Building a Holistic Financial Ecosystem

Bold differentiates itself by offering additional layers of services beyond basic payment processing. By integrating financial products such as insurance and software solutions tailored for merchants’ needs, Bold aims to evolve into a comprehensive financial ecosystem. This multifaceted approach aligns with General Atlantic’s vision of integrating banking services and software solutions to empower merchants and drive long-term success.

Future Roadmap and Expansion Plans

With the latest funding infusion, Bold intends to strengthen its product roadmap and broaden its service offerings. By transitioning from a payments link provider to a holistic financial services provider, Bold seeks to enhance merchant experiences and foster sustainable growth. Moreover, the company’s recent acquisition of a financial institution license enables it to offer banking services, further enriching its value proposition and solidifying its position as a trusted financial partner for merchants in Colombia.