Revolutionizing SME Banking

Finom, a European challenger bank targeting small and medium-sized enterprises (SMEs) and freelancers, has secured €50 million ($54 million) in a Series B equity funding round. Founded in the Netherlands in 2019, Finom aims to streamline banking services for businesses, offering quick online account opening, international bank account numbers (IBANs), and comprehensive financial tools.

Addressing SME Needs

The funding underscores the growing demand for specialized financial services tailored to SMEs. Despite being underserved by traditional banks due to high compliance risks and limited lending opportunities, SMEs require sophisticated financial solutions. Finom’s co-founder and co-CEO, Yakov Novikov, highlights the challenges faced by SMEs and emphasizes the importance of catering to their diverse needs.

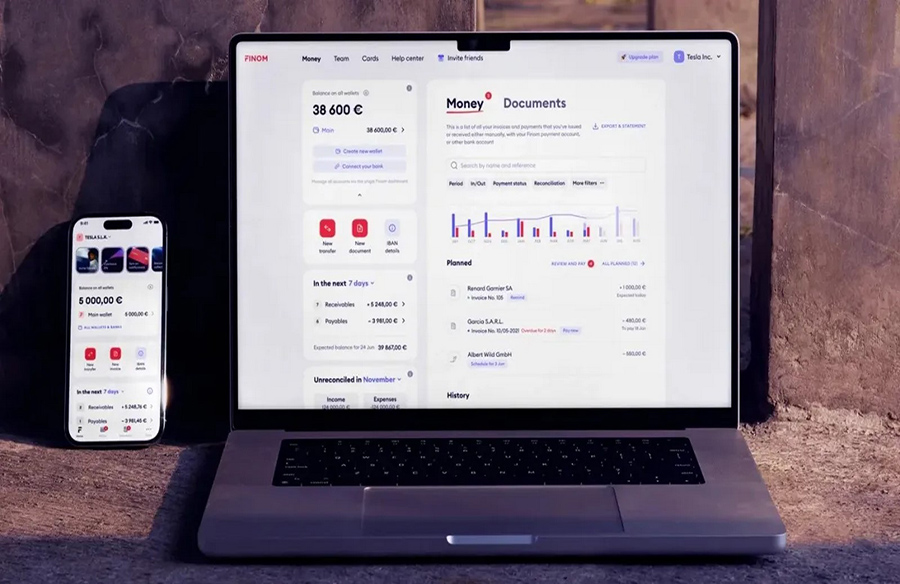

Fully Integrated Banking Solution

Finom distinguishes itself by providing a fully integrated platform covering banking, payments, invoicing, expense management, accounting, and business registration services. This consolidation of services not only enhances efficiency but also reduces costs for clients by eliminating the need for multiple service providers.

Growth and Expansion Plans

Having previously raised €50 million, including a Series A round, Finom is well-positioned to expand its operations across the Eurozone. With an electronic money institution (EMI) license, the startup operates within the European Union, serving customers in Germany, Spain, France, Italy, and the Netherlands. The latest funding round, co-led by Northzone and General Catalyst, will fuel Finom’s expansion efforts and localization initiatives in additional markets.

Investor Confidence and Partnerships

The Series B round, backed by prominent investors like Northzone and General Catalyst, demonstrates investor confidence in Finom’s vision and growth potential. Supported by strategic partnerships and a strong investor network, Finom aims to revolutionize SME banking and empower businesses across Europe.